Harness the giving power of a private foundation -without the complexity

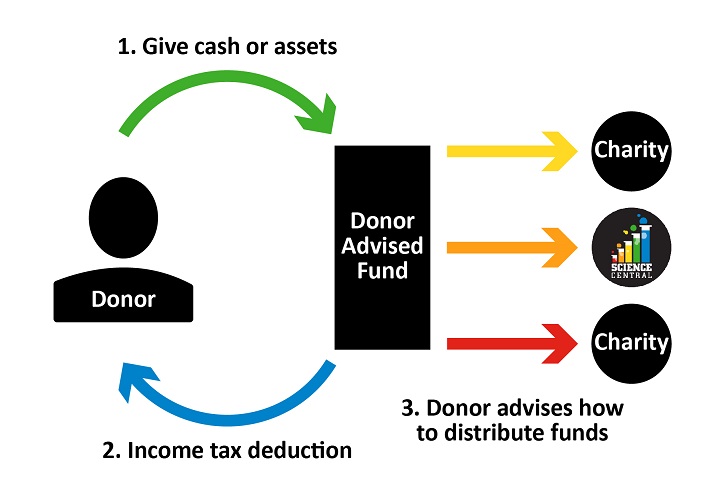

A donor-advised fund, which is like a charitable savings account, gives you the flexibility to recommend how much and how often money is granted to Science Central and other qualified charities. You can recommend a grant or recurring grants now to make an immediate impact or use your fund as a tool for future charitable gifts.

You can also create a lasting legacy by naming Science Central the beneficiary of the entire account or a percentage of the fund. With a percentage, you can create a family legacy of giving by naming your loved ones as your successor to continue recommending grants to charitable organizations. Contact your fund administrator for a beneficiary form.

Donor-advised funds can be created through the Community Foundation of Greater Fort Wayne, Schwab, Vanguard, Fidelity, and BNY Mellon.

An Example of How It Works

Joe and Laura realize they want to give back and help others by putting their money where it will do the most good. They start by establishing a $25,000 donor-advised fund with their local community foundation.

The couple received a federal income tax charitable deduction for the amount of the gift. They also get all the time they need to decide which charities to support.

After researching community needs with the foundation’s staff and discovering that STEM Education is a huge need in the region, Joe and Laura recommend a grant towards Science Central. The foundation presents Science Central a check from The Smith Family Fund, which Joe and Laura created so the whole family could get involved in giving back. They are excited to start this personal legacy of giving as a family.

Donor-Advised Funds Frequently Asked Questions

What is a Donor-Advised Fund?

A donor-advised fund (DAF) is an investment account that is used for charitable giving. It is composed of donations made by individuals and administered by a third party. The third party is called the sponsoring organization. It offers an immediate tax relief and allows you to support your favorite charities immediately or over time.

How does a Donor-Advised Fund work?

A donor makes an irrevocable gift to a donor-advised fund and received a tax deduction for the year the gift is made. Once the contribution is made, the sponsoring organization has legal control over the funds and the donor can make grant recommendations to the charity of their choice.

Are There Any Rules to Owning a Donor-Advised Fund?

The IRS has specific guidelines around the kinds of organizations that are eligible to receive grants as well as the purposes these grants can serve. For example, grants can only be made to qualified charities and cannot be made to a person, or the donor cannot receive more than an incidental benefit, so it cannot be used for the admission price of an event like a gala.

What’s the Difference Between a Donor-Advised Fund and a Direct Donation?

The DAF donor receives tax documentation from the sponsoring organization of the DAF while a direct donor receives tax documentation from the charity.

Can a Donor-Advised Fund Be Used to Donate to a Private Foundation?

Donor-Advised Funds can be used alongside private foundations.

What Are the Benefits of a Donor-Advised Fund?

- Easy to establish

- Flexible funding options

- Easily accessible

- Tax advantage

- Typically requires no minimum distribution

- Anonymous granting options

- Investment options

Is There a Tax Deduction for Donor-Advised Funds?

Yes, the DAF donor receives tax documentation from the sponsoring organization of the DAF.

EIN# 31-1032583 — Science Central — 1950 N. Clinton St. — Fort Wayne, IN 46805